modified business tax rate nevada

Under this system every business selling goods or services in Nevada must collect sales tax on those transactions. The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019.

Gusto Help Center Nevada Registration And Tax Info

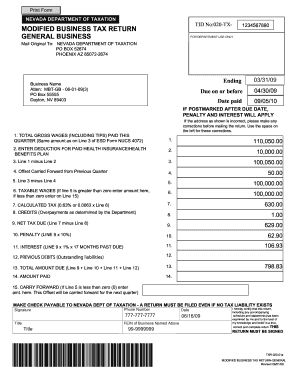

Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as.

. Businesses that have gross receipts of 4000000 or more per year are subject to the tax. Given businesses and individuals the opportunity to carry back net operating losses NOLs. In 2015 legislation was enacted to reduce both MBT rates if general tax revenues exceeded a.

The Nevada business tax as defined for the general business category is pursuant to NV Rev Stat 363B 2017. Every 2019 combined rates mentioned above are the results of Nevada state rate 46 the county rate 225 to 3665 and in some case special rate 0 to 025. Ask the Advisor Workshops.

Tax Bracket gross taxable income Tax Rate 0. The MBT rate is 117 percent. 10 -Nevada Corporate Income Tax Brackets.

It is assessed if taxable wages exceed. Nevada has no corporate income tax at the state level making it an attractive tax. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

But you knew this already. The CARES Act includes several significant business tax provisions that among other things has. The first type is called a gross receipts tax.

Nevada Unemployment Insurance Modified Business Tax. The modified business tax is described by the Nevada Department of Taxation as a quarterly payroll tax. Nevada State Payroll Taxes.

The Nevada Modified Business Tax is a tax on business gross receipts. Nevada levies a Modified Business Tax MBT on payroll wages. Clark County Tax Rate Increase - Effective January 1 2020.

On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was. Total gross wages are the. Click here to schedule an appointment.

There is one general rate 1475 percent and a higher rate for financial institutions 20 percent. Modified Business Tax Changes and. Enter your Nevada Tax Pre-Authorization Code.

Nevada has no state income taxes. What is the Modified Business Tax. The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries.

The tax rate is 1475 on wages. This is after the deduction of any health.

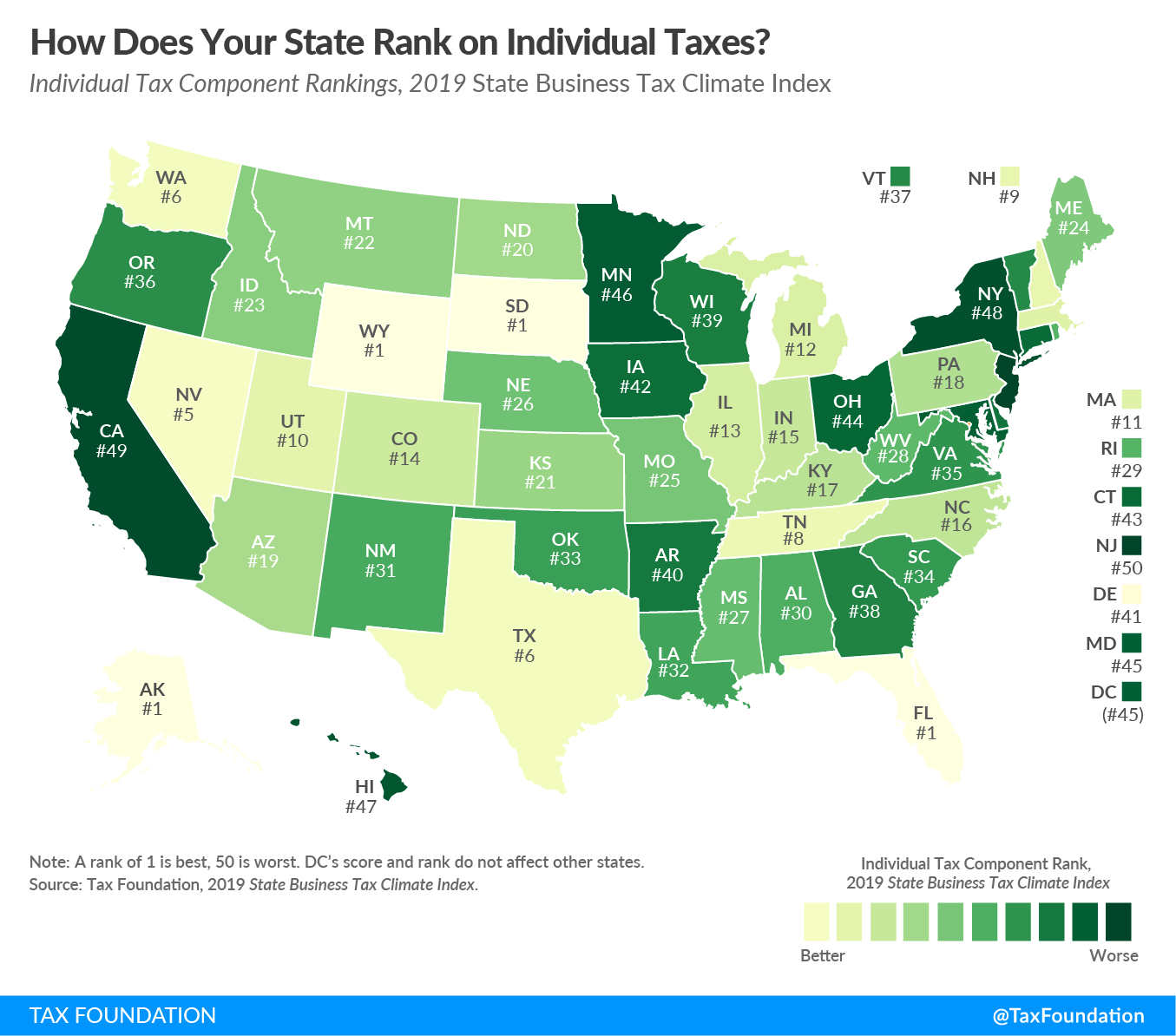

How Does Your State Rank On Individual Taxes 2019 State Rankings

Nevada Modified Business Tax Form 2019 Pdf Fill Out Sign Online Dochub

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

Employers To Receive Refunds Of Overpaid Nevada Modified Business Tax

Department Of Economics Ppt Download

Mining For Taxes Raising State Revenues In Nevada Nbm

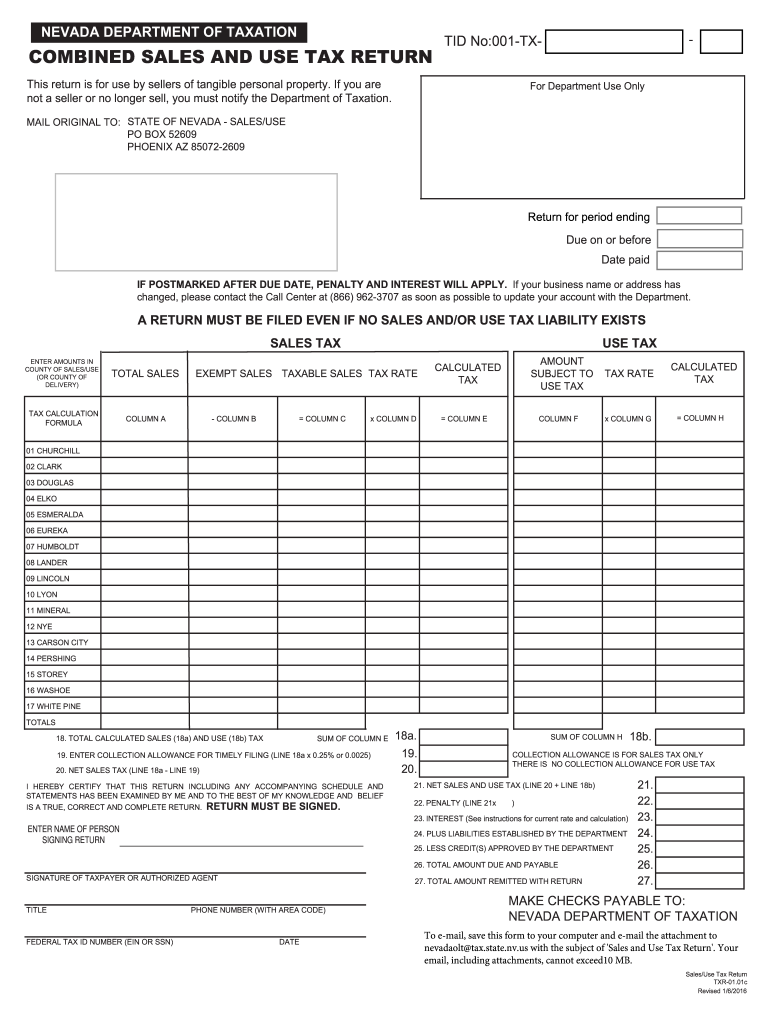

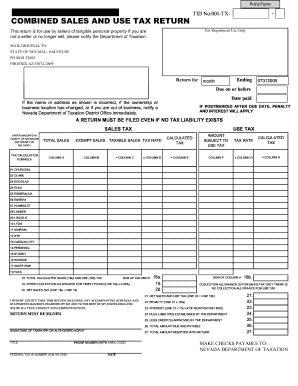

Sales Use Tax Nv Fill Out Sign Online Dochub

Nevada Modified Business Tax Form 2019 Pdf Fill Out Sign Online Dochub

Nv Dept Of Taxation 2010 Form Fill Out Sign Online Dochub

Marginal Tax Rates For Pass Through Businesses By State Tax Foundation

What Corporate Taxes Do Businesses Pay In Nevada Llb Cpa

Start Business In Nevada Incparadise

Nevada Sales Tax Fill Out And Sign Printable Pdf Template Signnow

Start Business In Nevada Incparadise

Nevada Supreme Court Rules Tax Increases Unconstitutional Las Vegas Review Journal

Nevada S Golden Child High Country News Know The West

Slt Nevada S New Tax Revenue Plan The Cpa Journal

Nevada Modified Business Tax Form Fill Out And Sign Printable Pdf Template Signnow